On the aggregate of the value of the net fixed assets and the current assets of the company in India after. Of the Companies Act 1967.

THE PAYMENT OF BONUS ACT 1965.

. Definitions of holding company wholly owned subsidiary and group of companies 9. FOURTH SCHEDULE Receivers and managers FIFTH SCHEDULE Winding up. Fourth Schedule Authorities entitled to grant licence Fifth Schedule.

The Adaptation of Laws Order 1950. Corporation tax in the United Kingdom is a corporate tax levied in on the profits made by UK-resident companies and on the profits of entities registered overseas with permanent establishments in the UK. This Act includes any regulations.

Until 1 April 1965 companies were taxed at the same income tax rates as individual taxpayers with an additional profits tax levied on companies. THE INDUSTRIAL DISPUTES ACT 1947. The Food Corporations Amendment Act 1968 57 of 1968.

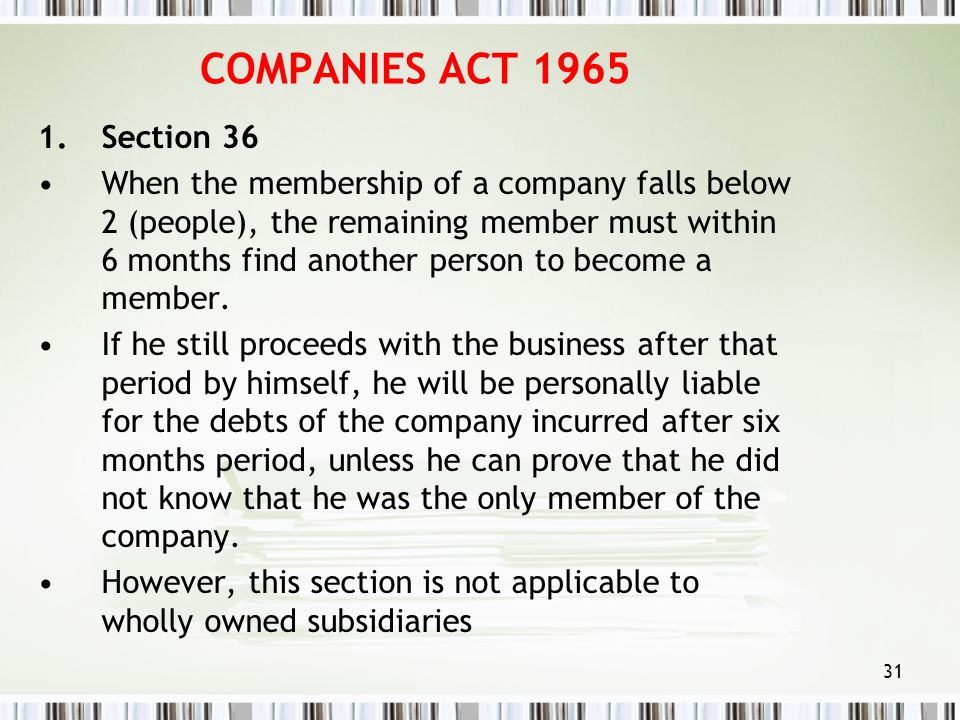

Every Company having a share capital is required by section 165 of The Companies Act1965 to prepare an annual return which must be made up to the date of the Annual General Meeting AGM of the company in the year or a date not later than 14th. Ordinance XIX of 1965 8 June 1965. 6 THE BANKING REGULATION ACT 1949 ACT NO.

Amendment Act 1965 35 of 1965. United Kingdom insolvency law regulates companies in the United Kingdom which are unable to repay their debts. Banking and Insurance Companies Act 1949 54 of 1949.

Paragraph 132b of the Fourth Schedule to the Act provides that an employer who ceased to be an employer in relation to an employee for example when an employee dies is required to deliver an employees tax certificate within 14 days of the date on which employment ceased to the former employee or to such deceased employees. Since the Cork Report of 1982 the modern policy of UK. FOURTH SCHEDULE Appointment of Nominated Members of Parliament FIFTH SCHEDULE Key Statutory Boards and Government Companies Legislative History Abbreviations Comparative Table.

THE FOURTH SCHEDULE THE FIFTH SCHEDULE. Insolvency means being unable to pay debts. Office of the Registrar.

Definition of subsidiary 8. Identification means a in the case of an individual issued with an identity card under the National Registration Act 1965 the number of the individuals identity card. Select All Clear.

46 of 1963 An Act to provide for the taxation of incomes and for. While UK bankruptcy law concerns the rules for natural persons the term insolvency is generally used for companies formed under the Companies Act 2006. Table A means Table A in the Fourth Schedule.

Construction of references in other Acts to companies registered under Companies Consolidation Act 1908 and Act of 1963. The word companies omitted by Act 23 of 1965 s. INCOME-TAX ACT 1961 43 OF 1961 AS AMENDED BY FINANCE ACT 2008 An Act to consolidate and amend the law relating to income-tax and super-tax BE it enacted by Parliament in the Twelfth Year of the Republic of India as follows CHAPTER I PRELIMINARY Short title extent and commencement.

The Banking Companies Acquisition and Transfer of Undertakings. A company registered under the Companies Act 1913 12. N 1ST JANUARY 1964 37 of 1964 N 10 of 1964 M 5 of 1965 33 of 1965 11 of 1966 7 of 1968 18 of 1898 14 of 1969 16 of 1969 19 of 1969 27 of 1970 14 of 1971 Ь.

The Interpretation Act 1965 shall apply for the purpose of interpreting this Constitution and otherwise in relation thereto as it applies for the. 21 This Act may be called the Income-tax Act. Montana State University PO Box 172660 Bozeman MT 59717-2660 Telephone.

Act structured to facilitate its use in relation to most common type of company. Lump-sum payment from pension funds FIFTH SCHEDULE 1. 10 OF 11949 10th March 1949 An Act to consolidate and amend the law relating to banking 2.

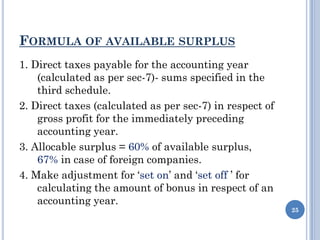

Provided that where the employer is a foreign company within the meaning of section 591 of the Companies Act 1956 1 of 1956 the total amount to be deducted under this Item shall be 85 percent.

Incorporation And Its Effects Ppt Video Online Download

The Technology Of Touch Screens Sept 15 2013 Informatica Y Computacion Tecnologia Informatica Computacion

.png)